10 Best Crypto Launchpads and IDOs in 2026: Complete Platform Comparison

The crypto launchpad market reached about 1.42 billion dollars in 2024 and is projected to grow to roughly 6.22 billion dollars by 2033. At the same time, the total crypto market cap sits near 3.9 trillion dollars, with more than 650 million people owning crypto.

What does this mean for you

If you are an investor, launchpads are one of the main ways to access early stage token sales. If you are a founder, the right launchpad can be the difference between an overlooked listing and a well supported, high visibility launch.

Not all platforms are equal. Some specialize in IEOs with heavy screening and exchange support. Others focus on IDOs, gaming, or multi chain support. In this guide, we walk through the best crypto launchpads to watch in 2026. You will see how each one works, who it serves best, and how a crypto marketing agency can help you maximize results from your launch.

What Are Crypto Launchpads

Crypto launchpads are platforms that connect new blockchain projects with early investors. They host token sales before a project gets fully listed on public markets, usually at an initial sale price that is lower than later market prices.

The model has evolved significantly since the 2017 ICO era, when almost anyone could raise funds with a website and a PDF. Today the main models are:

IEO (Initial Exchange Offering)

The token sale happens on a centralized exchange like Binance or KuCoin. The exchange screens projects, runs the sale, and lists the token. This adds credibility because top exchanges avoid obvious scams and reputation risk.IDO (Initial DEX Offering)

The token sale happens directly on decentralized exchanges or launchpad protocols. Tokens are listed on DEXs, and access is handled through smart contracts. This path is faster, permissionless, and often more aligned with decentralization.

The launchpad segment now has a combined capitalization of more than 1.90 billion dollars. For that to exist, both investors and projects must see value in the model.

For projects, launchpads provide:

Funding without relying only on traditional VCs

Exposure to the platform’s existing community

Faster liquidity after launch

Added trust through platform level screening

For investors, launchpads offer:

Earlier access to new tokens and ecosystems

Projects that have passed at least basic checks

Potential for higher returns if the project performs

Structured allocation systems instead of random OTC deals

The tradeoff is competition. Allocations are often oversubscribed, staking rules can be complicated, and even strong screening does not eliminate risk.

Snapshot: 10 Best Crypto Launchpads In 2026

Platform | Type | Main Focus | Total Raised* | Projects Launched* | Best For |

Binance Launchpad | IEO | Flagship CEX token sales | 188M+ USD | 91 | High exposure launches, BNB holders |

DAO Maker | IDO | Retail friendly IDOs | 99.5M+ USD | 178 | Long term focused investors, incubated projects |

Seedify | IDO | Gaming and metaverse | 26M+ USD | 72 | GameFi projects, P2E and metaverse investors |

Polkastarter | IDO (cross chain) | Multi chain token sales | 50M+ USD | 110+ | Cross chain projects needing flexibility |

KuCoin Spotlight | IEO | Curated, lower volume | Not disclosed | 26 | Quality screened mid size launches |

OKX Jumpstart | IEO | High value institutional raise | 2.7B+ USD | 12 | Large fundraising with OKX ecosystem |

Gate.io Startup | IEO | Accessible, high volume | 100M+ USD | 760+ | Smaller investors and mass market projects |

BSCPad | IDO | BSC native, guaranteed tiers | 40M+ USD | 70+ | BSC projects and allocation guaranteed investors |

GameFi Launchpad | IDO | Gaming and metaverse hub | 184M+ USD (gaming IDOs) | Not stated | Gaming ecosystems, multi chain game launches |

ByBit Launchpad | IEO / IDO hybrid | High performance listings | 4.3B+ USD | 32+ | Traders targeting explosive early stage plays |

*Numbers are approximate and rounded based on public reporting.

The 10 Best Crypto Launchpads In 2026

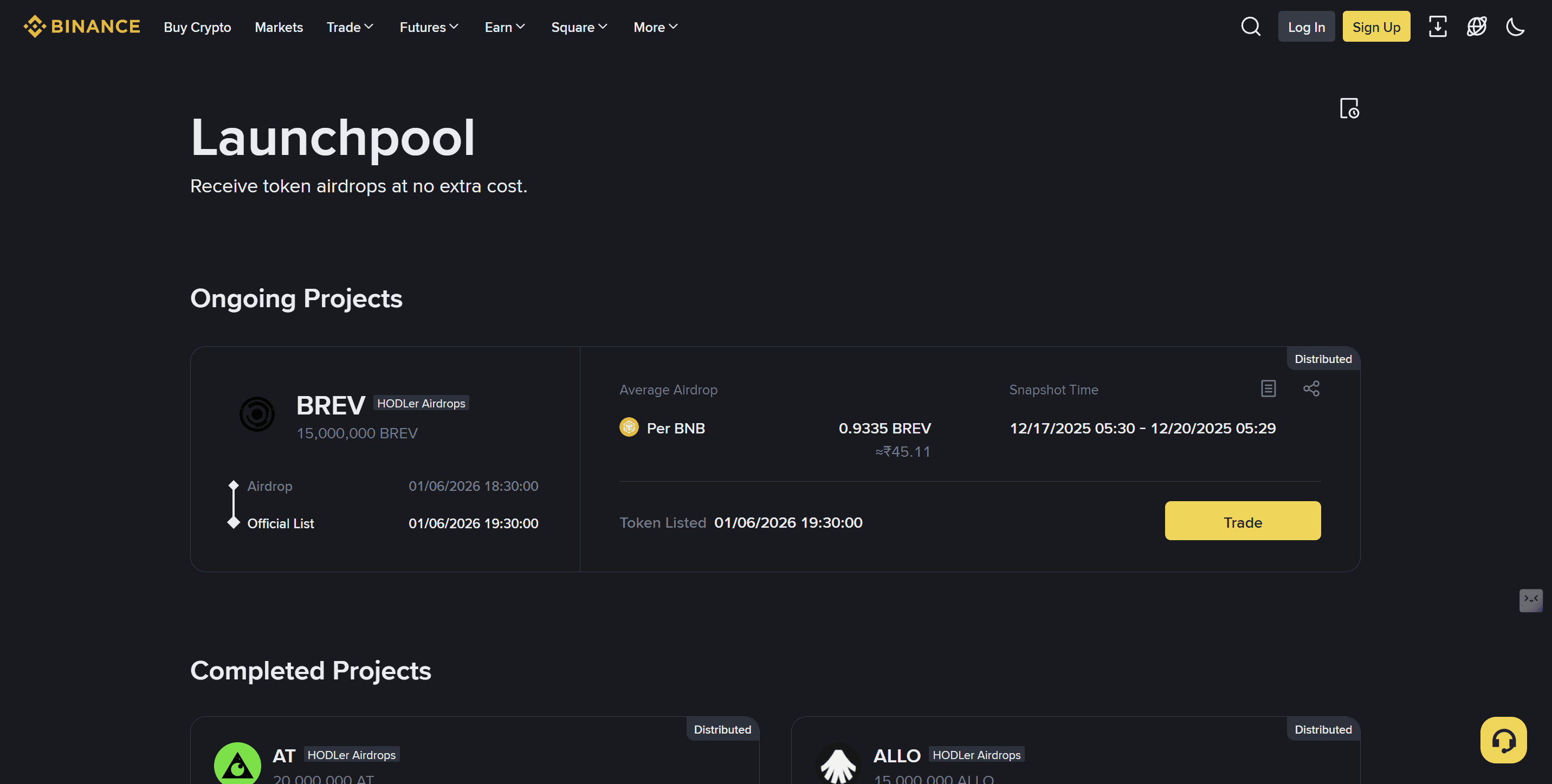

1. Binance Launchpad

Type: IEO

Founded: 2019

Total Raised: 188M+ USD

Projects Launched: 91

Binance Launchpad remains one of the strongest IEO platforms in the industry. Historically, roughly 94 percent of projects have delivered positive returns at some point after listing, which is unusually high in crypto terms.

First day average returns often reach above one thousand percent, and all time peaks can be far higher. Flagship projects include:

Axie Infinity (AXS)

Polygon (MATIC)

The Sandbox (SAND)

StepN (GMT)

BitTorrent (BTT)

Binance is selective. Only a small percentage of applicants make it to Launchpad, and participants need to hold BNB and pass KYC. Allocations are calculated based on the amount of BNB held during a snapshot period.

Best for:

Projects that want global visibility and strong exchange backing

Investors who already hold BNB and want curated, high profile listings

2. DAO Maker

Type: IDO

Founded: 2017

Total Raised: 99.5M+ USD

Projects Launched: 178

DAO Maker is one of the few launchpads that can credibly claim positive average current returns across its IDOs. It raised more than 22M USD in December 2024 alone, showing activity even outside peak bull cycles.

Notable launches include:

My Neighbor Alice

Orion Protocol

LaunchX

DAFI Protocol

Key design features:

Strong Holder Offerings (SHOs): Rewards long term holders instead of pure first come first served buyers.

Dynamic Coin Offerings: Includes milestone based refund options, giving investors partial downside protection if a team fails to deliver.

Participation typically requires at least 250 DAO tokens staked, along with KYC. For projects, DAO Maker offers incubation, advisory support, and help with token economics.

Best for:

Investors who prefer structured downside protection and long term frameworks

Projects that want full stack support, not just a fundraising event

3. Seedify

Type: IDO (Gaming and Metaverse)

Founded: March 2021

Total Raised: 26M+ USD

Projects Launched: 72

Seedify focuses specifically on GameFi and metaverse projects. This specialization has helped it stand out in a crowded launchpad market.

Headline results:

Bloktopia (BLOK) returned about 558x at its peak.

SIDUS HEROES reached around 109x.

ChainGPT delivered approximately 42x.

SFUND token holders vote on which projects move forward. That community governance element aligns platform success with its most committed users. Seedify is also multi chain, which allows teams to choose the most suitable network.

Best for:

Web3 gaming studios and metaverse projects

Investors who want focused exposure to the play to earn and GameFi sectors

4. Polkastarter

Type: IDO (Cross chain)

Founded: December 2020

Total Raised: 50M+ USD

Projects Launched: 110+

Polkastarter was early in enabling cross chain IDOs. It supports Ethereum, BNB Chain, Solana, Polkadot, Polygon, Avalanche, and Celo, giving founders flexibility on infrastructure.

Highlights include:

Genesis Shards, the first IDO to raise on Ethereum and BSC simultaneously.

Meme.com, the first Polygon based IDO, which raised about 500k USD in MATIC.

Strong attention for projects like Wilder World and SuperVerse.

Polkastarter uses fixed swap pools for sales. Instead of auction style pricing, tokens are sold at a fixed price, helping to prevent gas wars and front running. POLS holders can join guaranteed or priority pools depending on tier.

One important note: in mid 2024, Binance moved POLS to its Monitoring Tag list, and the token has been undergoing a POLS v2 migration. Teams should factor this into risk considerations.

Best for:

Cross chain projects that want flexible infrastructure

Communities comfortable with on chain IDO mechanics and pool based sales

5. KuCoin Spotlight

Type: IEO

Founded: March 2019

Projects Launched: 26

User Base: More than 5M registered users

KuCoin Spotlight runs on a quality over quantity model. Its acceptance rate is below 10 percent, and an internal panel of more than twenty specialists reviews project fundamentals, tokenomics, and market fit.

Notable Spotlight launches:

Victoria VR

LUKSO

Cryowar

Chumbi Valley

Average ROI across all Spotlight projects is roughly 4.86x, which puts it in the higher performing tier of IEO platforms. The SUI public sale is a good example of scale: around 250,000 users bought 225M SUI at 0.10 USDT per token.

Best for:

Investors who like centralized exchange screening and smaller, curated pipelines

Teams that want rigorous review and KuCoin listing as part of their strategy

6. OKX Jumpstart

Type: IEO

Founded: 2019

Projects Launched: 12

Total Raised: 2.7B+ USD

OKX Jumpstart has fewer launches than competitors but extremely high fundraising volume. With more than 2.7B USD raised across twelve projects, the average raise exceeds 200M USD.

Examples:

Blockchain Brawlers delivered around 14,000 percent ROI at its peak.

Other strong launches include Taki, Element Black, KlayCity, WOO Network, and Toncoin.

Users stake OKB to receive allocations according to how much they commit during the subscription period. After the launch, tokens trade on the OKX centralized platform and, in some cases, on associated DEX infrastructure.

Best for:

Projects targeting large capital raises from a global exchange audience

Investors already integrated into the OKX ecosystem and holding OKB

7. Gate.io Startup

Type: IEO

Founded: 2013

Total Raised: 100M+ USD

Projects Launched: 760+

Gate.io Startup is one of the most accessible launchpads. Entry thresholds are lower than on many top exchanges, making it a strong option for smaller investors and emerging teams.

Key points:

More than 760 projects have launched through Startup.

Around 56 percent of them have produced a positive ROI at some point, which is notable in such a high volume environment.

Airdrop campaigns alone have raised close to 100M USD worth of tokens across the user base.

Gate.io places strong emphasis on security, and its interface is beginner friendly. This combination makes it a popular choice for retail heavy launches.

Best for:

Newer investors who want a gentle on ramp into launchpads

Projects that want wide distribution and are comfortable with moderate screening rather than ultra selective curation

8. BSCPad

Type: IDO (BSC focused)

Founded: 2020

Total Raised: 40M+ USD

Projects Launched: 70+

BSCPad was the first decentralized IDO platform native to Binance Smart Chain. Its main selling point is guaranteed allocations for all tiers, which solves a common complaint about lottery only systems.

How it works:

Users stake BSCPad to reach a tier.

In the first round, each tier receives a guaranteed allocation.

Any remaining tokens move to a First Come First Served phase.

This combination gives both committed stakers and active community members a fair shot. Tokens typically list on PancakeSwap immediately after the IDO.

Notable launches include AIOZ Network, Outer Ring, Fight of the Ages, Tidez, and Movez. Sectors range from DeFi to gaming and NFTs, all within the BSC ecosystem.

Best for:

BSC projects that want ecosystem native support and DeFi liquidity

Investors who dislike pure lottery systems and want guaranteed allocation frameworks

9. GameFi Launchpad

Type: IDO (Gaming and Metaverse)

Founded: August 2021

Total Raised: 184M+ USD across gaming IDOs

GameFi Launchpad is built specifically for gaming and metaverse projects. It operates as more than just a sale platform. The broader ecosystem includes:

Fantasy gaming elements

PVP modes and lotteries

Its own NFT marketplace

Staking pools with yields that can reach close to 51 percent for GAFI holders

The minimum entry tier is only 20 GAFI, which keeps access open to smaller investors. Lower tiers use a lottery system, while higher tiers receive guaranteed allocations. The system is chain agnostic, which allows projects built on various blockchains to use it.

Projects like Step Hero, MetaGods, and Kaby Arena have used GameFi Launchpad to tap into early supporters. The platform aims to serve both traditional gamers and Web3 native users.

Best for:

Gaming studios that want a launchpad plus ecosystem support

Investors looking for structured exposure to play to earn and gaming tokens

10. ByBit Launchpad

Type: IEO / IDO hybrid

Founded: September 2021

Total Raised: 4.3B+ USD

Projects Launched: 32+

ByBit Launchpad has built a reputation for very strong early performance. Several of its projects have delivered multi thousand percent gains in their first week.

Examples:

GENE gained roughly 3,938 percent in its first week.

KASTA reached around 2,050 percent.

REAL climbed about 1,847 percent.

The process is straightforward:

Snapshot period where users commit BIT or USDT.

Subscription or lottery round.

Allocation calculation.

Token distribution and listing on ByBit.

The STEPN (GMT) launch is one of the best known examples, with 420M GMT sold to more than 130,000 users, helping propel STEPN into mainstream awareness.

Allowing USDT as well as BIT opens the door for users who are not long term BIT holders, while still rewarding BIT stakers with better allocation terms.

Best for:

Active traders who are comfortable with fast moving launches

Projects wanting direct access to a large derivatives heavy trading community

Key Trends Shaping Launchpads In 2026

The launchpad landscape is not static. Several trends are reshaping how projects launch, how investors participate, and what “value” looks like in this space.

1. DeFi Integration

More launchpads now:

Reward staking with yield while users wait for IDOs or IEOs.

Offer liquidity mining or farming incentives tied to launchpad tokens.

Integrate with DEXs for one click migration from allocation to liquidity provision.

This gives investors extra yield and creates deeper liquidity for newly launched tokens.

2. Layer 2 Scaling

Layer 2 solutions help to:

Cut gas costs for smaller investors.

Enable fairer participation without gas wars.

Allow micro allocations that would not be viable on L1 due to fees.

Launchpads that tap into L2 networks can reach a broader base of retail users without pricing them out.

3. Security Upgrades

Security expectations have increased. Launchpads now:

Use multisig or MPC wallets for treasury and sale contracts.

Commission independent security audits before going live.

Enforce KYC and AML on both project teams and investors in many jurisdictions.

Implement verifiable lottery mechanisms for transparent allocation.

These steps do not eliminate risk, but they raise the standard significantly compared to the 2017 ICO era.

4. Multi Chain and Interoperability

Modern launchpads increasingly support several chains. This:

Lets projects choose the best infrastructure for their use case.

Increases the potential investor pool.

Reduces dependence on a single ecosystem’s health or narrative.

Bridges and cross chain messaging systems allow tokens to move or mirror across chains after launch, which is now a key factor for many investors.

5. AI Assisted Evaluation

Some platforms are experimenting with AI and data driven scoring to:

Evaluate tokenomics sustainability.

Analyze on chain histories of team wallets.

Compare new projects against historical performance of similar models.

It is early, and human judgment still dominates, but AI will likely become a standard supporting tool on both the project and investor side.

6. Memecoin and Creator Launchpads

Fast moving memecoin launchpads and creator token platforms have appeared to:

Let creators launch tokens quickly without deep infrastructure.

Capture attention driven, narrative heavy capital.

While risk is significantly higher, this shows that launchpads are fragmenting into several verticals, from institutional grade infrastructure to high velocity speculative environments.

How Launchpads Support Crypto Marketing

Top launchpads are not just fundraising tools. They also act as powerful marketing engines.

When you list on a strong launchpad, you receive:

Immediate access to a pre existing, engaged community of investors.

Visibility through the launchpad’s social channels, newsletter, and announcements.

Trust transfer from the platform’s brand, which helps with user confidence.

Liquidity and price discovery from day one, which are essential for narrative building.

A specialized crypto marketing agency can layer on top of this by:

Designing messaging that fits the launchpad’s audience.

Running coordinated campaigns across X, Telegram, Discord, Reddit, and YouTube.

Managing community expectations during the launch window.

Supporting both pre launch hype and post launch retention.

This is the same type of work agencies do for ICO and IDO campaigns in general, but tuned to the specific mechanics, timelines, and user behavior patterns of launchpad environments.

Wrapping Up

The market for crypto launchpads in 2026 offers more options than ever. A few key takeaways:

Binance Launchpad delivers high visibility and a strong track record of positive project performance.

DAO Maker adds investor friendly mechanisms like refund options and strong holder offerings.

Seedify and GameFi Launchpad specialize in gaming and metaverse, which is ideal if you are building in that vertical.

Polkastarter gives cross chain flexibility for projects that need multi chain reach.

OKX Jumpstart and ByBit Launchpad focus on large, high impact raises and very trading oriented audiences.

Gate.io Startup and BSCPad make it easier for smaller investors to participate, with BSCPad solving allocation frustrations via guaranteed tiers.

The launchpad space continues to evolve. We see platforms:

Integrating DeFi yield.

Leveraging Layer 2 scaling.

Improving security and compliance.

Experimenting with AI and new verticals like creator tokens.

Choosing the right launchpad comes down to your goals, your community, and your risk tolerance. As always, research each platform carefully and never invest more than you can afford to lose.

Frequently Asked Questions

1. How long does it take to launch a project on a crypto launchpad

Timelines vary. If your token, legal structure, and documentation are ready, some launchpads can move in a matter of weeks. If tokenomics, contracts, compliance, and marketing still need work, expect one to three months of preparation.

2. Will a launchpad handle legal and regulatory compliance for my project

Most launchpads will provide frameworks for KYC and AML and may have minimum legal requirements. However, they do not replace legal counsel. If you are raising meaningful capital or targeting multiple regions, you should consult specialist lawyers.

3. Can a project raise funds in stages through launchpads

Yes. Many teams combine:

Private or seed rounds

Strategic or VC allocations

Public IDO or IEO rounds

Launchpads typically handle the public phase, but some also support earlier rounds through private pools, strategic sales, or dual stage offerings.

4. How can projects measure investor engagement during a launch

Good launchpads provide dashboards that show:

Number of participants and total committed capital

Geographic or account level distribution of investors

Staking and subscription activity

Post listing trading volume and liquidity

You should combine these with your own metrics, such as website traffic, social growth, and on chain activity.

5. Do launchpads provide marketing support

Some do. Many exchanges and launchpad platforms offer:

Email announcements

In app or on site banners

Social media pushes

Referral programs or trading competitions

Working with a crypto marketing partner alongside the launchpad can extend this reach and turn exposure into long term community growth.

6. What support do launchpads provide after the token sale

Support levels vary. Some launchpads:

Help with liquidity management and market making partners.

Offer advisory calls or follow up promotion.

Run staking, farming, or listing campaigns to keep interest alive.

When you compare platforms, look not only at fundraising statistics, but also at how projects perform and remain supported after the initial sale. That post launch phase often determines whether your token becomes a lasting ecosystem or just another short term trade.